China’s Soaring Vehicle Population: Even Greater than Forecasted?

- Read the paper in Energy Policy

- Learn more about the ITS-Davis China Center

- Learn more about Dan Sperling

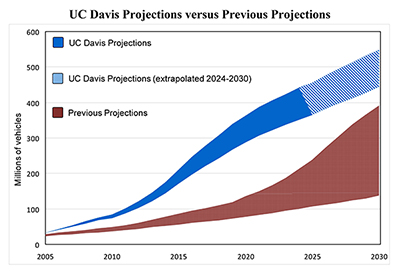

Researchers from the ITS-Davis China Center for Energy and Transportation explore the possibilities in a new paper, “China’s Soaring Vehicle Population: Even Greater than Forecasted?” published this month in Energy Policy. China Center Director Yunshi Wang, ITS-Davis Director Dan Sperling, and Ph.D. student Jacob Teter outline a different approach to projecting China’s future vehicle population growth, arriving at a startling conclusion: Commonly accepted projections of 6% to 11% annual growth between the early 2000s and 2020 are conservative.

The UC Davis team thinks China’s vehicle population is just as likely to grow 13% to 17% per year.  The implications are as alarming as the numbers. “It’s shattering the world view of China,” Sperling says. “It’s very possible that there will be many more vehicles consuming much more oil and emitting much more CO2 than is projected by the world’s leading energy agencies. And that means global oil security and climate change challenges are even more daunting, more problematic than anyone has assumed.”

The implications are as alarming as the numbers. “It’s shattering the world view of China,” Sperling says. “It’s very possible that there will be many more vehicles consuming much more oil and emitting much more CO2 than is projected by the world’s leading energy agencies. And that means global oil security and climate change challenges are even more daunting, more problematic than anyone has assumed.”

In addition to taking the top spot in the world vehicle market, China now has the dubious distinction as the world’s largest CO2 emitter and second-largest oil importer, Sperling notes. It’s important to get projections right because forecasts are the foundation for all global studies about the future of oil and greenhouse gases.

“We hope we’re wrong. But in the spirit of scientific investigation, it’s important to appreciate the possibility.”

The paper outlines several methodological and empirical reasons for the previous conservative forecasts. First, explains Wang, nearly all major projections relied on forecasted gross domestic product (GDP) growth rates to generate vehicle per capita growth curves. Forecasts underestimated China’s recent GDP growth, dampening their vehicle purchase projections. “Their forecasts were based on the premise that the recent growth is an anomaly,” Wang notes.

A second important difference between the UC Davis researchers’ findings and previous projections involves the choice of benchmark countries. The UC Davis team examined historical experiences in seven large vehicle-producing countries: Japan, United States, Italy, Spain, Germany, South Korea, and Brazil. Previous studies built forecasting models on large datasets that included from 45 to 122 countries, many of which are tiny or do not have their own automotive industry. Countries with large auto industries tend to support the development of their industry and thus experience much higher vehicle growth than other countries.

Wang asks, “China is not at all similar to Singapore. Why include data from this comparison?” Adds Sperling: “This paper challenges the conventional view of vehicle population growth. It says, if you look at the experience in other auto-producing countries, there is plenty of reason to think that vehicle growth could continue at current rates approaching 18%.”

A third important distinction is the timeframe of the projections. Most previous forecasts relied on World Bank or International Monetary Fund data that only go back to the 1960s. Thus, projections ignored the 1950s when motorization was especially rapid in many large vehicle-producing countries, Wang says. By choosing fewer benchmark countries and those from which they could also obtain data from the 1950s and before, the UC Davis team captured experiences that are analogous to China’s current market experience.

While Wang is confident the team’s assumptions are reasonable and based on solid data, he admits there’s always uncertainty in making longer-term projections. Sperling and Wang say the study has helped strengthen the relationships between the ITS-Davis China Center and its research and government colleagues in China.

Wang sees the center playing a role in China’s efforts to develop more sustainable transportation systems. The UC Davis team also has benefited from an interesting scientific study. “Because China is changing so fast, it’s a living laboratory. Plus, it’s central to international policy on climate and energy security,” says Sperling. “This work points to the importance of understanding in an empirical way how change happens – instead of just crunching numbers. It’s an elegant approach that is emblematic of the Institute’s way, where researchers conduct cutting-edge analysis with a sophisticated understanding of real-world data.”

Thank you for your interest in the UC Davis Institute of Transportation Studies. Subscribe today to keep up with the latest ITS news and happenings.